It's been a good while since I shared any detailed analysis of my microstock earnings, there has been plenty going on over the past couple of years in changing royalties. Putting all the change, discussion, boycotts, rates and price structures to one side then probably the most important consideration for any photographer is what's happening to my revenue?

Agency Earnings Compared

Last time I shared a look at comparative revenue was back at the start of 2012, for the 12 months of Jan to Dec 2011, as an update I've looked at the 12 months to July 2015. A gap of 2.5 years, and a long time in microstock!

My earnings are up at almost all agencies, approximately 50% up on average, this despite me not uploading many images during the past 4 years (less than 15% portfolio increase). The main reason for the increase is an increase in revenue per sale i.e. prices to buyers are going up.

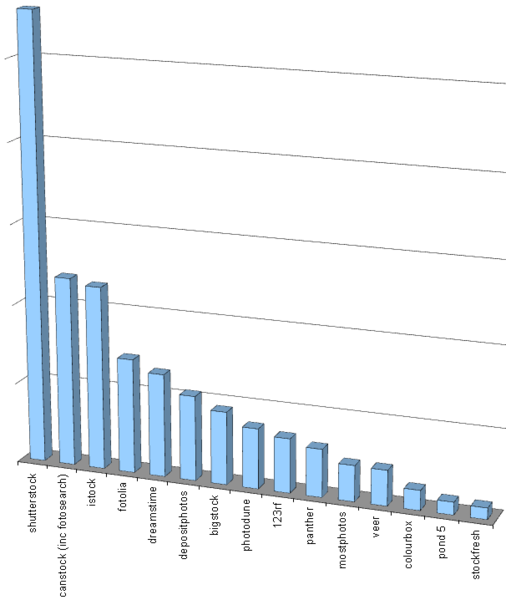

Shutterstock have taken out an astonishing lead, the graph below has it's Shutterstock bar chopped in half so that the rest of the graph is more readable - their bar is huge compared to the others, they bring me around 5x that of each of the next two agencies (canstock and istock) and are not too far from earning me the same as all the other agencies combined.

Earnings Comparison Graph: Since 2006 I have uploaded the same portfolio of images to all agencies, new agencies receive the back catalogue of images and are then included in all future uploads. (the only exceptions: photocase, alamy). Each agency has chosen to accept and reject whatever images they want - that's fine, they can curate their collections as they please I'm only interested in comparing aggregate earnings from image sales at each agency. You should group together agencies ranked below 15 as they would be prone to statistical error, earnings from those sites were very low.

Rankings Compared to 2011

| Current Rank | Agency | Rank-2011 | Change |

| 1 | shutterstock | 1 | 0 |

| 2 | canstock (inc fotosearch) | 5 | 3 |

| 3 | istock | 3 | 0 |

| 4 | fotolia | 4 | 0 |

| 5 | dreamstime | 2 | -3 |

| 6 | depositphotos | 10 | 4 |

| 7 | bigstock | 6 | -1 |

| 8 | photodune | 9 | 1 |

| 9 | 123rf | 7 | -2 |

| 10 | panther | 8 | -2 |

| 11 | mostphotos | 14 | 3 |

| 12 | veer | 11 | -1 |

| 13 | colourbox | New | |

| 14 | pond 5 | New | |

| 15 | stockfresh | 15 | 0 |

| 16 | zoonar | 16 | 0 |

| 17 | featurepix | 19 | 2 |

| 18 | photocase | New | |

| 19 | crestock | 18 | -1 |

| 20 | cutcaster | 17 | -3 |

| 21 | yaymicro | 12 | -9 |

There is a surprising amount of stability, notable exceptions being yaymicro disappearing out of the back door. Canstock continue to quietly climb their way up the table (quite a dark horse that agency) but climbing from 5 to 2 and overtaking istock, dreamstime and fotolia has been driven in most part by syndicated sales from fotosearch rather than direct sales on their own site. I'm opted-in to all syndication/reseller options and these earnings are included in the comparison (except for Fotolia and DCP where I was opted out).

Depositphotos is the highest climber, these figures are from before their recent pricing and royalty changes.

There is pretty clear evidence for me that we are not in a race to the bottom with prices to buyers. Prices for individual images are up quite sharply over the past 4 or so years (dollar photo club excepted), likewise the gap between agency revenue and contributor payout is also growing - agency keeps more, the photographer gets a smaller share.

Pricing Changes

In the past couple of years we have seen plenty of "price re-alignments". Flat rate pricing (istockphoto), new subscription offers with high resolutions for a fraction of the price of a buying the same images on a credit based process; new subscriptions that don't really lock the buyer in to anything! Because it’s a subscription payment the royalty can also be a suitable "fraction" to photographers, and for photographers that now rather withered and dried up carrot has been dangled out again: “there will be higher volumes of sales because….”.

Regardless of whether or not those agencies are cannibalising their own credit based purchases to sell a subscription to the same customer, all I see is somewhat less sales but much more revenue. This all seems counterintuitive but I've checked my numbers. Can my small portfolio of 'simple images' be so different from everyone else? Am I earning more at the expense of those whose photos had higher production values? Do images in older portfolios earn more? I don't think so.

Of course everyone's portfolio is different, but I'm not seeing any doom and gloom here. The doom and gloom comes from agency announcements and forums. Have we all become so negative when reading those announcements or is it just me looking at the world through cold blue coloured glasses?

The Obfuscated Royalty Rate Cuts

We've only seen direct royalty cuts from depositphotos in the past year, and that combined with an increase in price to the end user. Looking at their numbers it brings them more in line with the other agencies. DP have grown their market share, and their library to 30 million images, so the incentive of a higher rate for "new" photographers is no longer needed, likewise cheap prices to attract new buyers (a gamble perhaps)

Instead of direct cuts a new trend has emerged. Agencies now offer ‘new’ subscription systems and regular 'new' pricing schemes...streamlining and bringing us 'good news', divide credits 5:1 and round up... some perversely describe this as simplification.

Like rationalisation is a euphemistic way of describing job-cuts, I think there is a risk that ‘simplification’ is becoming a synonym of royalty-cuts AND customer price increases. Seems that no agency dare mention cutting royalty rates directly, like everything political we have to go all-round-the-houses first.

We reached a spectacular low last July with depositphotos 3% royalty on a subscription sale (monthly subscription). A 'daily subscription' that offered 5 images a day over a month @ $79, with a high resolution pay-as-you go download on DP costing 10 credits, and each credit costing ~$1 (at the time) any customer downloading more than 8 high res images a month will be in the market to switch to a subscription, that's great for DP: those daily subscription sales results in at worst 56% payout to the contributors if all images are downloaded (rare!), the pay-as-you-go sales would mean a payout of 44%-60%. More likely the scenario that e.g. 23% of revenue paid out if half the allowance is used. DP later 'reconsidered' the offer.

It does seem that recent complaints and boycotts from the photographer community did have some effect, forcing agencies to provide opt-outs, and in some cases to send individual emails to ex-contributors incentivising them back after they deleted their portfolios or opted-out.

Pricing subscriptions is not easy. We know from Shutterstock who lose money if a subscriber downloads all images they could each day/month, buyers do not normally use up all of their entitlement in a subscription. Much fairer is iStocks minimum payout solution where photographers earn more if a buyer uses only use part of their entitlement.

The details of how and in what way a subscription is offered is not what I have issue with here, it's the introduction of subscriptions and changes to them in an veiled attempt by some agencies to increase the numbers of download but keep more revenue for themselves. However If I'm earning more each month I'm not complaining, and that seems to be what's happening.

So what about DollarPhotoClub, Fotolia and Adobe

Hindsight is a wonderful thing, the launch of DollarPhotoClub (DPC) sounded like the end of the world to many contributors, but now the future for DPC looks bleak, the site is closed to new members. We can only speculate on the reasons:

- Not the business that Fotolias new owners Adobe want to be associated with?

- A model not compatible with attracting the best images to Fotolia and in turn to Adobe stock?

- A model that turned out to be a financial disaster or at not earning enough to stay viable long term?

We'll probably never know. I'm fairly sure the buyers that used it were pretty happy with the site. As an ex-subscriber myself (it was by far the best value way to buy photos!!!) I found it to be a well executed product, although the marketing and customer communication was (perhaps suitably so) somewhat trashy and overzealous.

The Bottom Line

Subscriptions seem to be the new way to obfuscate royalty rates by making it really hard to compare one agency to with another - it has the same effect for buyers. A subscription is a simple number of images provided in a fixed time for a fixed price, that bit is "simplification". Working out what will save buyers money or generate more revenue to photographers is much harder.

Despite changes to rates and sale prices here, there, and everywhere: my income is up and I'm off to upload some more photos ;)

Related Reading:

The istock shuffle: seanlockephotography.com/2014/09/02/istockphoto-shuffle

New istock offer: michaeljayfoto.com/agency-news/the-new-istock-offer

Lack of inspection spells doom microstockgroup.com/istockphoto-com/istocks-lack-of-inspection-standards-spell-more-doom

Changes at 123rf microstockgroup.com/123royaltyfree-com/royalties-on-%27download-pack%27-aren%27t-at-your-level (this thread really makes things much clearer..... ummm)

Envato lay the foundations to install smoke and mirrors in the future microstockgroup.com/photodune/a-more-balanced-envato-market/

Changes to prices at depositphotos microstockdiaries.com/depositphotos-raises-prices-and-lowers-royalties.html

Canstockphoto syndication

Giovanni (not verified) on Fri, 2015-09-11 15:56Opted in for all

Steve Gibson on Sat, 2015-09-12 05:33Interesting insights

Lee Torrens (not verified) on Fri, 2015-09-11 19:21My Intention

Steve Gibson on Sat, 2015-09-12 05:24Thanks, and yes that's my intention for posting this: to see if others find 'broadly' the same/similar.

There are obviously going to be exceptions for different ports. But canstock were pushed up a few places for me last time I looked in 2012, so it's not a one off thing at least in my case, they would be 11th without those fotosearch sales (so it seems it's fotosearch that are doing well fo them/me)

10% was my rough estimate on things: port still at a modest 900 or so images - acceptance has been all over the f***** place, most agencies have taken around 5 or 600 in lifetime. I added almost 100 images Jan 2012 to present. For those that took all images that's an increase might be 20%+ to what I had with them (istock who switched from v. picky to v. open). There are agencies have been really brutal to me and only taken 20% of what I submitted so the 'average rise' is much smaller.

The other variable to confuse things: my photography is getting much better than it was 10 years ago, and I have a much better eye for things that would or would not sell

I guess I really should start tracking more than just overall earnings to understand more, but at the end of the day I don't think that would tell me anything that I could act on personally - it would just be very interesting from a market perspective. (I mean that last para WRT the overall picture; of course analysis of individual sellers, groups of styles, subject types is well worth looking at to learn and increase earnings)

from MSG

Steve Gibson on Sun, 2015-09-13 00:17just read this from someone on microstockgroup:

"In August, for me, iStock was beat by CanStock. Let me repeat that, iStock was beat by CANSTOCK. (i'm illustration, btw)"

http://www.microstockgroup.com/istockphoto-com/photo-sales-decline-since...

Income

Alexander Jemeljanov (not verified) on Sat, 2015-12-19 13:29Hi Steve, seems you earn similar amount on

1. Fotolia + DreamsTime + DP + BigStock

2. CanStock + iStock

3. Shutterstock

Is it right? As my microstock experience (hobby level) shows that Shutterstock gives more than all other stock combined :)

Also Im planning to write a post about my income report on microstocks soon, so it will be possible to compare portfolios / incomes.

Of course, all portfolios are unique, but anyway it gives some understanding.

How much more?

Steve Gibson on Thu, 2015-12-31 00:31How much more does shutterstock earn for you than the others combined?

as I wrote, shuterstock for me "are not too far from earning me the same as all the other agencies combined."

Yes, sorry I was not

Alexander Jemeljanov (not verified) on Sat, 2016-01-09 22:45